What are the insurance resources for self-help legal representation? This is a question that many people have, especially those who are facing legal issues and do not have the financial means to hire an attorney. In this article, we will discuss the different types of insurance policies that may cover legal expenses, the benefits and limitations of using insurance for self-help legal representation, and how to file a claim for legal expenses under an insurance policy.

There are a number of different types of insurance policies that may cover legal expenses, including homeowner’s insurance, renter’s insurance, auto insurance, umbrella insurance, and legal expense insurance. Each type of policy has its own unique set of benefits and limitations, so it is important to compare policies before purchasing one.

For example, homeowner’s insurance typically covers legal expenses related to property damage or personal injury, while renter’s insurance typically covers legal expenses related to theft or vandalism.

Insurance Resources for Self-Help Legal Representation

Self-help legal representation can be a cost-effective way to resolve legal issues without hiring an attorney. However, there are some costs associated with self-help legal representation, such as court filing fees, document preparation fees, and expert witness fees. Insurance can help cover these costs and provide peace of mind in case of an unexpected legal issue.There are several types of insurance policies that may cover legal expenses.

These include:

- Homeowners insurance:Most homeowners insurance policies include coverage for legal expenses related to property damage or personal injury claims.

- Renters insurance:Renters insurance policies typically include coverage for legal expenses related to property damage or personal injury claims.

- Auto insurance:Auto insurance policies usually include coverage for legal expenses related to car accidents.

- Legal insurance:Legal insurance policies provide coverage for a wide range of legal expenses, including self-help legal representation.

Using insurance to cover the costs of self-help legal representation has several benefits. First, it can help you save money on legal expenses. Second, it can provide peace of mind in case of an unexpected legal issue. Third, it can help you get access to legal assistance that you might not otherwise be able to afford.However, there are also some limitations to using insurance to cover the costs of self-help legal representation.

First, not all insurance policies cover legal expenses. Second, even if your insurance policy does cover legal expenses, there may be limits on the amount of coverage that is available. Third, using insurance to cover the costs of self-help legal representation may increase your insurance premiums.Overall, insurance can be a valuable resource for individuals seeking self-help legal representation.

However, it is important to carefully consider the benefits and limitations of using insurance before making a decision.

Types of Insurance Policies Covering Legal Expenses

Various insurance policies may provide coverage for legal expenses, offering financial protection in the event of legal disputes or proceedings. These policies can be categorized into the following types:

Homeowner’s Insurance

Homeowner’s insurance typically includes liability coverage that can extend to legal defense costs if the homeowner is sued for an incident occurring on their property. This coverage can include defense against personal injury claims, property damage claims, and even slander or libel claims.

Renter’s Insurance

Similar to homeowner’s insurance, renter’s insurance provides liability coverage for tenants. It can cover legal expenses incurred due to lawsuits arising from accidents or incidents within the rented premises.

Auto Insurance

Auto insurance policies often include uninsured/underinsured motorist coverage, which can provide legal representation if the policyholder is involved in an accident with a driver who lacks sufficient insurance coverage. Additionally, some auto insurance policies may offer optional legal expense coverage, providing reimbursement for attorney fees and other legal costs.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of other insurance policies. It can extend to legal defense costs in cases where the policyholder is sued for an amount exceeding the coverage provided by their primary insurance policies.

Legal Expense Insurance

Legal expense insurance is a specialized policy designed to cover legal expenses for a wide range of legal issues. It can provide coverage for legal advice, representation in court, and other expenses related to legal disputes. This type of insurance can be particularly beneficial for individuals or businesses who anticipate potential legal challenges.

Benefits of Using Insurance for Self-Help Legal Representation

Navigating the legal system can be a daunting and expensive process. Insurance for self-help legal representation offers a cost-effective and convenient solution, providing individuals and families with access to experienced legal professionals and reducing the stress associated with legal matters.

Cost Savings

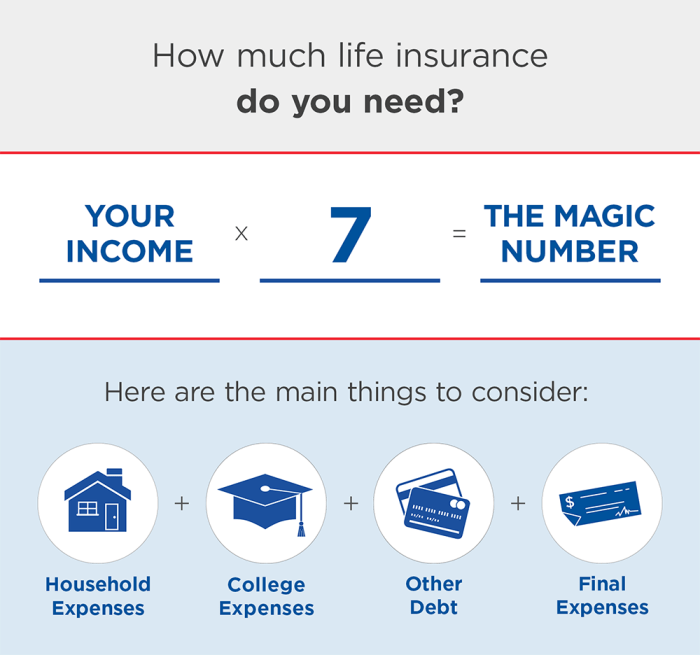

Legal fees can quickly accumulate, putting a significant financial burden on individuals and families. Insurance for self-help legal representation helps mitigate these costs by providing coverage for legal expenses, including attorney fees, court costs, and other related expenses. According to the American Bar Association, the average cost of hiring an attorney can range from $150 to $300 per hour, making insurance a valuable investment for those facing legal challenges.

Access to Experienced Legal Professionals

Self-help legal representation insurance grants policyholders access to a network of experienced legal professionals who can provide guidance and support throughout the legal process. These professionals can assist with a wide range of legal issues, including family law, estate planning, real estate disputes, and employment law.

By leveraging the expertise of legal professionals, individuals can increase their chances of success in their legal endeavors.

Reduced Stress and Anxiety

Legal matters can be incredibly stressful and anxiety-provoking. Insurance for self-help legal representation can alleviate this burden by providing individuals with peace of mind. Knowing that they have access to legal support can reduce the stress and anxiety associated with navigating the legal system, allowing them to focus on other important aspects of their lives.

– Identify and discuss the potential limitations of using insurance for self-help legal representation, such as

While insurance can provide valuable coverage for legal expenses, it’s essential to be aware of potential limitations that may impact its effectiveness for self-help legal representation.

Some common limitations include:

Coverage Limits

Insurance policies typically have coverage limits, which represent the maximum amount the insurer will pay towards legal expenses. Exceeding these limits can leave individuals responsible for any remaining costs.

Example: A policy with a $5,000 coverage limit may not be sufficient to cover the full costs of a complex legal matter.

Exclusions

Insurance policies may exclude certain types of legal matters from coverage. For instance, some policies may not cover criminal defense, family law, or business disputes.

Example: A policy that excludes criminal defense would not provide coverage for an individual facing criminal charges.

Deductibles

Deductibles are the amount individuals must pay out-of-pocket before insurance coverage begins. High deductibles can make it difficult to access legal assistance, especially for individuals with limited financial resources.

Example: A policy with a $1,000 deductible may require individuals to pay this amount before the insurance company covers any legal expenses.

Eligibility Requirements for Insurance Coverage

Obtaining insurance coverage for legal expenses is subject to certain eligibility requirements that vary depending on the insurance provider and the specific policy. These requirements typically include:

Residency

Insurance coverage for legal expenses is generally available to individuals who reside in the state or country where the insurance policy is issued. This is because the laws and regulations governing insurance contracts and legal representation vary from jurisdiction to jurisdiction.

Age

Most insurance providers have age restrictions for obtaining coverage for legal expenses. The minimum age requirement may vary, but it is typically set at 18 or 21 years old. There may also be an upper age limit, such as 65 or 70 years old, beyond which coverage may not be available.

Income

Some insurance providers may consider income when determining eligibility for coverage for legal expenses. This is because income can be an indicator of an individual’s ability to pay for legal representation without insurance coverage.

Property Ownership

In some cases, insurance providers may require individuals to own property, such as a home or vehicle, as a condition of obtaining coverage for legal expenses. This is because property ownership can be seen as a sign of financial stability and responsibility.

How to File a Claim for Legal Expenses

Filing a claim for legal expenses under an insurance policy can be a complex process. However, by following these steps, you can increase your chances of success:

Contact the Insurance Company

The first step is to contact your insurance company and inform them that you are filing a claim for legal expenses. You will need to provide them with your policy number and the details of your case.

Submit Documentation

Once you have contacted the insurance company, they will send you a claim form. You will need to complete this form and submit it to the insurance company along with the following documentation:* A copy of your insurance policy

- A letter from your attorney explaining the nature of your case and the legal expenses you have incurred

- Invoices or receipts for any legal expenses you have already paid

Negotiate with the Insurance Adjuster

Once the insurance company has received your claim form and documentation, they will assign an adjuster to your case. The adjuster will review your claim and determine whether it is covered under your policy. If the adjuster approves your claim, they will negotiate with you to determine the amount of coverage you will receive.

Write a Demand Letter

If you are unable to reach an agreement with the insurance adjuster, you may need to write a demand letter. A demand letter is a formal letter that Artikels your claim and the amount of coverage you are seeking.

File a Lawsuit

If the insurance company denies your claim or refuses to pay the full amount of coverage you are seeking, you may need to file a lawsuit. Filing a lawsuit is a complex process, and you should consult with an attorney before taking this step.

| Step | Timeline |

|---|---|

| Contact the insurance company | Immediately |

| Submit documentation | Within 30 days of receiving the claim form |

| Negotiate with the insurance adjuster | Within 60 days of submitting documentation |

| Write a demand letter | Within 30 days of receiving the adjuster’s decision |

| File a lawsuit | Within one year of the date the claim was denied |

Include specific examples of legal aid organizations, pro bono attorneys, and online legal resources.

There are a number of organizations that provide legal assistance to individuals who cannot afford to hire an attorney. These organizations include:

- Legal Aid Societies:Legal aid societies are non-profit organizations that provide free or low-cost legal services to low-income individuals. To qualify for legal aid, you must meet certain income and asset requirements.

- Pro Bono Attorneys:Pro bono attorneys are lawyers who volunteer their time to represent low-income individuals.

To find a pro bono attorney, you can contact your local bar association or legal aid society.

- Online Legal Resources:There are a number of online legal resources that can provide you with information about your legal rights and options. These resources include:

- Legal Aid Self-Help Center:The Legal Aid Self-Help Center provides free legal information and resources to low-income individuals.

- LawHelp.org:LawHelp.org is a website that provides free legal information and resources to low-income individuals.

- Nolo:Nolo is a publisher of self-help legal books and software.

Factors to Consider When Choosing an Insurance Policy

When choosing an insurance policy that covers legal expenses, it is important to consider several key factors that can impact the cost and coverage of the policy. These factors include:

- Coverage limits:The coverage limits of an insurance policy determine the maximum amount of money that the policy will pay for legal expenses. It is important to choose a policy with coverage limits that are sufficient to cover the potential legal costs that you may incur.

- Exclusions:Insurance policies often have exclusions that specify certain types of legal expenses that are not covered. It is important to carefully review the exclusions of a policy before you purchase it to make sure that it covers the types of legal expenses that you are most likely to incur.

- Deductibles:The deductible of an insurance policy is the amount of money that you must pay out of pocket before the insurance company will start to pay for legal expenses. A higher deductible will result in a lower premium, but it will also mean that you will have to pay more out of pocket if you need to file a claim.

- Premiums:The premium of an insurance policy is the amount of money that you pay to the insurance company each month or year. The premium will vary depending on the coverage limits, exclusions, and deductibles of the policy.

The following table compares different insurance policies based on these factors:| Policy| Coverage Limits| Exclusions| Deductibles| Premiums||—|—|—|—|—|| Policy A | $100,000 | None | $500 | $100/month || Policy B | $250,000 | Criminal defense | $1,000 | $150/month || Policy C | $500,000 | Personal injury | $2,000 | $200/month |As you can see from the table, the coverage limits, exclusions, deductibles, and premiums of insurance policies can vary significantly.

It is important to compare different policies and choose the one that best meets your needs and budget.In addition to the factors listed above, there are a number of other factors that you may also want to consider when choosing an insurance policy, such as:

- The reputation of the insurance company

- The financial stability of the insurance company

- The customer service record of the insurance company

By considering all of these factors, you can choose an insurance policy that will provide you with the coverage and peace of mind that you need.

Tips for Maximizing Insurance Coverage for Self-Help Legal Representation

Maximizing insurance coverage for self-help legal representation is essential to ensure you receive the full benefits of your policy. By following these practical tips, you can increase your chances of obtaining the coverage you need to pursue your legal matters effectively.

Documenting Legal Expenses

Keep a detailed record of all legal expenses incurred, including receipts, invoices, and bank statements. This documentation will be crucial when filing a claim and demonstrating the extent of your expenses.

Negotiating with the Insurance Company

Don’t hesitate to negotiate with your insurance company if your initial claim is denied or if the offered settlement is insufficient. Be prepared to provide supporting evidence and documentation to justify your request for additional coverage.

Appealing Denied Claims

If your claim is denied, don’t give up. You have the right to appeal the decision. Review the denial letter carefully and gather evidence to support your appeal. Consider seeking legal advice to strengthen your case.

Importance of Timely Communication

Timely communication with your insurance company is crucial. Notify them promptly of any legal issues you encounter and submit your claim as soon as possible. Delays in communication can jeopardize your coverage.

Benefits of Hiring an Attorney

Hiring an attorney to assist with the insurance claim process can provide several benefits. An attorney can help you navigate the legal complexities, negotiate with the insurance company, and maximize your coverage.

Checklist of Essential Documents

Before filing a claim for self-help legal representation, gather the following essential documents:

- Insurance policy documents

- Legal expense receipts and invoices

- Proof of income and assets

- Documentation of the legal issue and your efforts to resolve it

Case Studies of Successful Use of Insurance for Self-Help Legal Representation

Individuals have successfully used insurance to cover the costs of self-help legal representation in various legal scenarios. Here are some real-life examples:

Tenant-Landlord Dispute

A tenant faced eviction proceedings due to unpaid rent. The tenant’s homeowners insurance policy included coverage for legal expenses. The tenant used the insurance to hire an attorney who successfully negotiated a payment plan and prevented the eviction.

Employment Discrimination

An employee alleged discrimination in the workplace. The employee’s life insurance policy included an employment law rider. The employee used the insurance to cover the costs of hiring an attorney who represented them in a successful discrimination lawsuit.

Estate Planning

An individual needed to create a will and estate plan. The individual’s auto insurance policy offered a legal services benefit. The individual used the insurance to cover the costs of hiring an attorney who drafted a will and other necessary estate planning documents.

Case Studies of Denied Claims for Self-Help Legal Representation

Despite the potential benefits of using insurance for self-help legal representation, it is important to be aware of the potential limitations and pitfalls. One of the most significant challenges is the risk of having a claim denied.

There are several reasons why an insurance company may deny a claim for self-help legal representation. Some of the most common reasons include:

- The policy does not cover self-help legal representation.Some insurance policies specifically exclude coverage for self-help legal representation. It is important to carefully review your policy to determine if it provides coverage for this type of representation.

- The claim is not covered by the policy’s definition of “legal expenses.”Many insurance policies define “legal expenses” narrowly, and may not include coverage for self-help legal representation. For example, some policies may only cover legal expenses incurred in connection with a lawsuit.

- The claim is not reasonable or necessary.Insurance companies may deny claims for self-help legal representation if they determine that the representation is not reasonable or necessary. For example, an insurance company may deny a claim for self-help legal representation if the individual could have obtained the same representation from a pro bono attorney or legal aid organization.

Avoiding Denied Claims

There are several steps that individuals can take to avoid having a claim for self-help legal representation denied. These steps include:

- Carefully review your insurance policy.Before filing a claim, carefully review your insurance policy to determine if it provides coverage for self-help legal representation. If you are unsure whether your policy provides coverage, you should contact your insurance company for clarification.

- Document your claim.When filing a claim for self-help legal representation, it is important to document your claim thoroughly. This documentation should include evidence of the legal expenses that you incurred, as well as evidence of the necessity of the representation.

- Be prepared to negotiate.If your claim is denied, you may be able to negotiate with your insurance company to obtain coverage. Be prepared to provide additional documentation or evidence to support your claim.

Legal Implications of Using Insurance for Self-Help Legal Representation

Utilizing insurance for self-help legal representation raises significant legal implications that warrant careful consideration.

One crucial aspect is the attorney-client privilege. Insurance companies may have access to confidential communications between the policyholder and their attorney, which could compromise the privilege and potentially harm the case.

Conflicts of Interest

Insurance companies have a financial interest in minimizing payouts, which can create conflicts of interest with the policyholder’s legal interests. For instance, the insurer may pressure the policyholder to settle for less than fair compensation or to pursue a less favorable legal strategy.

Ethical Considerations, What are the insurance resources for self-help legal representation

Attorneys who represent policyholders under insurance coverage have ethical obligations to both their client and the insurance company. Balancing these obligations can be challenging, especially if the insurer’s interests conflict with the client’s goals.

Ethical Considerations for Attorneys Providing Self-Help Legal Representation

Ethical considerations play a pivotal role in the provision of self-help legal representation by attorneys. Attorneys must adhere to specific ethical guidelines to ensure that clients receive competent and ethical legal assistance while navigating the complexities of the legal system.

These ethical considerations encompass a range of issues, including maintaining objectivity, avoiding conflicts of interest, and ensuring that clients fully comprehend the risks and benefits of self-help legal representation.

Maintaining Objectivity

Attorneys providing self-help legal representation must maintain objectivity and impartiality throughout the representation. They should not allow their personal beliefs or biases to influence their legal advice or representation. This requires attorneys to set aside their own opinions and focus solely on the client’s interests and legal rights.

Avoiding Conflicts of Interest

Attorneys must diligently avoid conflicts of interest that could impair their ability to provide effective and ethical representation. This includes situations where the attorney has a personal or financial interest in the outcome of the case or has previously represented an adverse party.

Attorneys must disclose any potential conflicts of interest to the client and take appropriate steps to avoid or mitigate any conflicts.

Ensuring Client Understanding

Attorneys providing self-help legal representation must ensure that clients fully understand the risks and benefits of self-help legal representation. This includes explaining the limitations of self-help legal representation, the potential consequences of representing oneself, and the importance of seeking legal advice from an attorney if necessary.

Attorneys should also ensure that clients understand the scope of the representation and the attorney’s role in providing guidance and support.

Resources Available to Attorneys Providing Self-Help Legal Representation

Attorneys who provide self-help legal representation can access various resources to enhance their knowledge and skills. These resources include:

Training Programs

* In-person workshops:Provide hands-on training on specific legal topics or self-help representation techniques.

Online webinars

Offer convenient and accessible training on various legal issues and self-help strategies.

Mentorship programs

Connect attorneys with experienced mentors who can provide guidance and support.

Practice Guides

* How-to manuals:Provide step-by-step instructions on handling common legal matters and self-help procedures.

Sample pleadings and motions

Offer templates and examples of legal documents commonly used in self-help representation.

Checklists

Ensure attorneys consider all necessary steps and requirements when providing self-help legal assistance.

Legal Research Databases

* Subscription-based services:Offer comprehensive legal databases with access to case law, statutes, and legal analysis.

Free and open-source resources

Provide access to legal information and materials without subscription fees.

Government databases

Contain legal resources, such as court decisions, regulations, and administrative rulings.

Future Trends in Insurance for Self-Help Legal Representation

The insurance industry is constantly evolving, and several emerging trends may significantly impact self-help legal representation in the future.

The Rise of Technology-Based Legal Services

Technology is rapidly changing the legal landscape, and the rise of technology-based legal services is one of the most significant trends. These services use artificial intelligence (AI) and other technologies to provide legal assistance to individuals and businesses. They can help with tasks such as document review, legal research, and even providing legal advice.

As these services become more sophisticated, they may make it easier and more affordable for people to get the legal help they need.

The Increasing Demand for Affordable Legal Assistance

The cost of legal services has been rising for years, and this trend is expected to continue in the future. This makes it increasingly difficult for people to afford the legal help they need. Insurance can help to make legal assistance more affordable, and the demand for insurance products that cover self-help legal representation is expected to grow in the future.

The Changing Regulatory Landscape

The regulatory landscape for insurance is also changing, and this could have a significant impact on self-help legal representation. In recent years, there has been a growing trend towards regulating the sale of insurance products. This trend is likely to continue in the future, and it could make it more difficult for insurance companies to offer products that cover self-help legal representation.

Ending Remarks: What Are The Insurance Resources For Self-help Legal Representation

If you are facing legal issues and do not have the financial means to hire an attorney, you may want to consider using insurance to cover your legal expenses. There are a number of different types of insurance policies that may cover legal expenses, so it is important to compare policies before purchasing one.

Be sure to read the policy carefully to understand the coverage limits and exclusions, and be sure to file a claim promptly if you need to use the coverage.

FAQ Compilation

What is self-help legal representation?

Self-help legal representation is when you represent yourself in court without the assistance of an attorney. This can be a good option for people who cannot afford to hire an attorney or who have a simple legal issue that they can handle on their own.

What are the benefits of using insurance for self-help legal representation?

There are a number of benefits to using insurance for self-help legal representation, including:

- Cost savings: Insurance can help you save money on legal expenses.

- Access to experienced legal professionals: Insurance companies often have relationships with experienced legal professionals who can provide you with advice and guidance.

- Reduced stress and anxiety: Using insurance for self-help legal representation can help you reduce stress and anxiety by providing you with peace of mind knowing that you are covered in the event of a legal issue.

What are the limitations of using insurance for self-help legal representation?

There are also some limitations to using insurance for self-help legal representation, including:

- Coverage limits: Insurance policies typically have coverage limits, which means that they will only cover up to a certain amount of legal expenses.

- Exclusions: Insurance policies often have exclusions, which means that they will not cover certain types of legal expenses.

- Deductibles: Insurance policies often have deductibles, which means that you will have to pay a certain amount out of pocket before the insurance company will start to cover your legal expenses.