What are the legal escrow resources for self-help legal representation – Legal escrow resources can provide a safe and secure way to manage funds in self-help legal representation. In this article, we will discuss what legal escrow is, how it works, and the benefits and drawbacks of using legal escrow services.

We will also provide a list of reputable legal escrow providers and tips on how to choose the right provider for your needs.

If you are considering using legal escrow for self-help legal representation, it is important to do your research and understand the risks and benefits involved. Legal escrow can be a valuable tool, but it is not right for everyone. By understanding the basics of legal escrow, you can make an informed decision about whether or not it is right for you.

Legal Escrow Overview

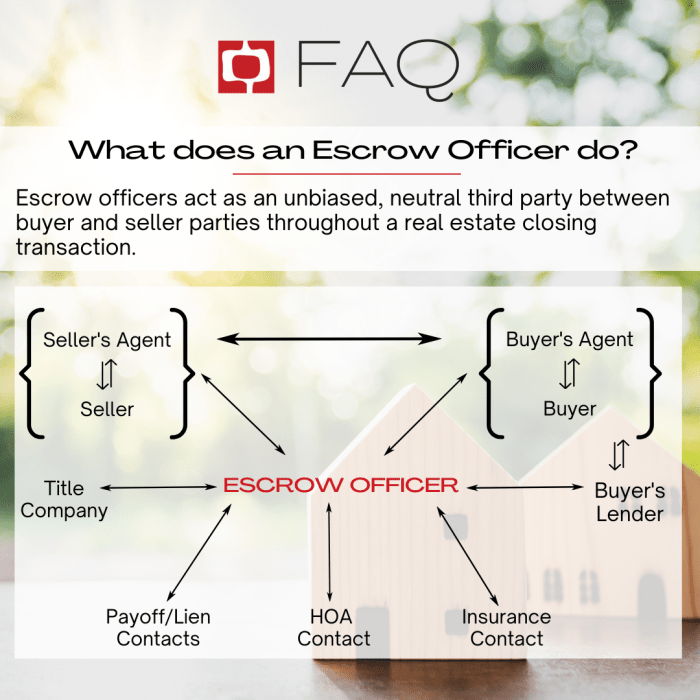

Legal escrow is a financial arrangement where funds are held by a neutral third party, known as an escrow agent, until certain conditions are met. In the context of self-help legal representation, legal escrow can provide a secure and convenient way to manage funds related to legal matters.

Legal escrow offers several benefits, including:

- Security:Funds held in escrow are protected from misuse or misappropriation by either party involved in the legal matter.

- Convenience:Escrow agents handle the disbursement of funds according to the terms of the escrow agreement, eliminating the need for direct financial transactions between the parties.

- Transparency:Escrow accounts are subject to regular audits and reporting, ensuring transparency and accountability in the management of funds.

However, there are also some drawbacks to using legal escrow services:

- Fees:Escrow agents typically charge fees for their services, which can add to the overall cost of legal representation.

- Time:Opening and closing an escrow account can be a time-consuming process, which may not be suitable for urgent legal matters.

- Restrictions:Escrow accounts may have restrictions on the types of transactions that can be processed, which may limit their flexibility for certain legal situations.

Legal escrow can be used in various legal contexts, including:

- Settlement of disputes:Escrow can be used to hold funds pending the resolution of a legal dispute.

- Real estate transactions:Escrow is commonly used in real estate transactions to hold the purchase price until the closing of the sale.

- Estate planning:Escrow can be used to manage the distribution of assets in accordance with the terms of a will or trust.

The legal requirements for establishing and maintaining a legal escrow account vary depending on the jurisdiction. However, generally, the following steps are involved:

- The parties to the legal matter agree to the terms of the escrow agreement.

- An escrow agent is appointed to hold the funds.

- The funds are deposited into the escrow account.

- The escrow agent disburses the funds according to the terms of the escrow agreement.

Types of Legal Escrow Services

Legal escrow services come in various types, each tailored to specific legal needs and circumstances. Understanding the different types available and their features will help you choose the right service for your situation.

Fixed Amount Escrow

Fixed amount escrow is a type of legal escrow service where a specific sum of money is held in escrow until a predefined condition is met. This type of escrow is commonly used in real estate transactions, where the buyer’s funds are held until the closing date or the fulfillment of certain conditions, such as the completion of inspections or repairs.

Features:

- Specific amount of money held in escrow

- Released upon fulfillment of predefined conditions

- Suitable for transactions with a fixed purchase price

Limitations:

- Not suitable for transactions where the purchase price is not fixed

- May require additional fees for modifications or extensions

Example:A homebuyer uses fixed amount escrow to hold their down payment until the closing date, when the funds are released to the seller upon completion of the transaction.

Finding a Legal Escrow Provider

Selecting a reliable legal escrow provider is crucial for safeguarding your interests. Consider the following factors:

Experience and Reputation

Choose providers with extensive experience in handling legal transactions. Check online reviews and testimonials to gauge their reputation.

Fees and Payment Structure

Compare the fees charged by different providers. Understand the payment structure and any additional costs involved.

Security Measures, What are the legal escrow resources for self-help legal representation

Ensure the provider employs robust security measures to protect your funds and sensitive information. Check for compliance with industry standards.

Customer Support

Choose providers with responsive and helpful customer support. Look for availability via phone, email, and live chat.

Reputable Legal Escrow Providers

Consider the following reputable legal escrow providers:

- Escrow.com

- Escrow.net

- Stripe Atlas

| Provider | Experience | Fees | Security | Customer Support |

|---|---|---|---|---|

| Escrow.com | 20+ years | Transaction-based fees | PCI DSS compliant | 24/7 support |

| Escrow.net | 15+ years | Flat-rate fees | SOC 2 Type II compliant | Email and phone support |

| Stripe Atlas | 5+ years | Subscription-based fees | PCI DSS and SOC 2 Type I compliant | Live chat and email support |

Checklist of Questions for Legal Escrow Providers

Ask potential providers the following questions:

- How long have you been in business?

- What types of legal transactions do you handle?

- What are your fees and payment structure?

- What security measures do you employ?

- How do you handle disputes?

- What customer support options do you offer?

Sample Escrow Agreement for Real Estate Transaction

An escrow agreement typically includes the following elements:

- Names of the parties involved

- Description of the property

- Purchase price

- Closing date

- Conditions for release of funds

- Dispute resolution process

Consult with an attorney to ensure the agreement aligns with your specific needs.

Fees and Costs Associated with Legal Escrow

Legal escrow services are not free, and it’s important to understand the fees and costs involved before using them. Fees vary depending on the provider, the complexity of the transaction, and the amount of money being held in escrow.Generally, legal escrow fees are calculated as a percentage of the total transaction amount.

The percentage can range from 0.5% to 3%, with higher fees typically charged for more complex transactions. Fees are typically due at the time the escrow account is opened, and they may be refundable if the transaction does not close.

Tips on Minimizing Fees and Costs

There are a few things you can do to minimize the fees and costs associated with legal escrow:

- Shop around and compare fees from different providers.

- Negotiate the fees with the provider.

- Use a provider that offers a flat fee instead of a percentage-based fee.

- Limit the amount of money you hold in escrow.

- Close the escrow account as soon as possible after the transaction is complete.

Using Legal Escrow in Self-Help Legal Representation

Legal escrow is a safe and secure way to hold funds or assets in trust for the benefit of two or more parties involved in a legal matter. It can be used in a variety of situations, including self-help legal representation.

When you represent yourself in a legal matter, it is important to have a clear understanding of the process and the potential risks involved. Legal escrow can help to protect your interests by ensuring that funds or assets are held in a neutral third-party account until the matter is resolved.

Steps Involved in Using Legal Escrow for Self-Help Legal Representation

- Choose a reputable legal escrow provider.

- Open an escrow account.

- Deposit the funds or assets into the escrow account.

- Provide the escrow instructions to the other party.

- Wait for the other party to sign the escrow instructions.

- The escrow agent will hold the funds or assets until the conditions of the escrow are met.

Examples of How Legal Escrow Can Be Used in Different Legal Matters

- Landlord-tenant disputes:Legal escrow can be used to hold security deposits or rent payments until a dispute between a landlord and tenant is resolved.

- Contract disputes:Legal escrow can be used to hold funds or assets until a contract dispute is resolved.

- Small claims court cases:Legal escrow can be used to hold funds or assets until a small claims court case is resolved.

Advantages and Disadvantages of Using Legal Escrow in Self-Help Legal Representation

Advantages

- Protects your interests by ensuring that funds or assets are held in a neutral third-party account.

- Can help to resolve disputes quickly and efficiently.

- Can save you time and money.

Disadvantages

- Can be expensive.

- Can be time-consuming.

- May not be appropriate for all legal matters.

How to Write a Legal Escrow Agreement

A legal escrow agreement is a contract that sets forth the terms of the escrow. It is important to have a written escrow agreement in place before you deposit any funds or assets into the escrow account.

The following are some of the key provisions that should be included in a legal escrow agreement:

- The names of the parties involved in the escrow.

- The purpose of the escrow.

- The terms of the escrow, including the conditions that must be met before the funds or assets can be released.

- The fees and costs associated with the escrow.

- The signature of all parties involved in the escrow.

Table Summarizing the Key Steps Involved in Using Legal Escrow for Self-Help Legal Representation

| Step | Description |

|---|---|

| 1 | Choose a reputable legal escrow provider. |

| 2 | Open an escrow account. |

| 3 | Deposit the funds or assets into the escrow account. |

| 4 | Provide the escrow instructions to the other party. |

| 5 | Wait for the other party to sign the escrow instructions. |

| 6 | The escrow agent will hold the funds or assets until the conditions of the escrow are met. |

Resources for Finding Legal Escrow Services

- American Bar Association Directory of Pro Bono Legal Services

- FindLaw Legal Escrow Services

- Nolo Legal Encyclopedia: How to Find a Legal Escrow Service

Legal Considerations

Using legal escrow services involves legal implications that must be carefully considered to safeguard your interests and mitigate potential risks. Understanding the legal aspects of legal escrow is crucial before engaging in any transactions.

It’s essential to consult with an attorney to fully comprehend the legal implications of using legal escrow. An attorney can provide personalized guidance based on your specific circumstances and ensure that your rights and interests are protected throughout the process.

Potential Risks and Liabilities

- Breach of Contract:If either party fails to fulfill their obligations under the escrow agreement, it could lead to a breach of contract. This can result in legal consequences, including financial penalties or legal action.

- Misuse of Funds:The escrow agent has a fiduciary duty to handle the funds in accordance with the escrow instructions. However, there is always a risk that the funds could be misused or misappropriated.

- Fraud or Identity Theft:Escrow transactions can involve large sums of money, making them a potential target for fraud or identity theft. It’s crucial to verify the legitimacy of the escrow provider and the parties involved to minimize these risks.

Protecting Your Interests

- Carefully Review the Escrow Agreement:Before signing the escrow agreement, thoroughly review its terms and conditions to ensure you understand your rights and obligations.

- Choose a Reputable Escrow Provider:Conduct thorough research to select an escrow provider with a proven track record of reliability and trustworthiness.

- Maintain Communication:Regularly communicate with the escrow agent and other parties involved in the transaction to stay informed and address any issues promptly.

- Consider Legal Representation:Consulting with an attorney can provide invaluable guidance and protection throughout the escrow process, especially if there are complex legal issues involved.

Alternative Options to Legal Escrow

While legal escrow offers several benefits for self-help legal representation, it’s essential to explore alternative options that may better suit your specific needs. Each alternative has its advantages and disadvantages, and understanding these nuances will help you make an informed decision.

Online Dispute Resolution (ODR) Platforms

- ODR platforms provide a neutral online forum for disputing parties to resolve their issues without the need for legal representation or court proceedings.

- Advantages: Cost-effective, efficient, and accessible to parties regardless of location.

- Disadvantages: May lack the formal structure and enforceability of legal escrow, and may not be suitable for complex or high-value disputes.

Mediation and Arbitration

- Mediation and arbitration involve the use of a neutral third party to facilitate a resolution between disputing parties.

- Advantages: Can be less adversarial than court proceedings, and can preserve relationships between parties.

- Disadvantages: Can be more expensive than ODR, and the outcome may not be legally binding unless agreed upon by both parties.

Self-Service Legal Document Preparation

- Online legal document preparation services allow you to create legal documents, such as contracts and wills, without the need for an attorney.

- Advantages: Cost-effective and convenient, especially for simple legal matters.

- Disadvantages: May not be suitable for complex legal issues, and it’s crucial to ensure the accuracy and validity of the documents created.

Choosing the Right Alternative

The best alternative to legal escrow depends on the nature of your dispute, your budget, and your comfort level with the legal process. Consider the following factors when making your decision:

- Complexity of the Dispute: If your dispute is complex or involves significant financial or legal issues, legal escrow may be a more suitable option.

- Cost: Legal escrow can be more expensive than other alternatives, so it’s important to weigh the costs against the potential benefits.

- Your Legal Knowledge: If you have limited legal knowledge, legal escrow can provide you with additional protection and guidance.

- Your Comfort Level: Choose an alternative that you feel comfortable with and that aligns with your preferred approach to resolving disputes.

Additional Resources

Seeking additional resources on legal escrow and self-help legal representation can enhance your understanding and empower you to make informed decisions. A plethora of information is available online, and various organizations offer support and guidance.

Websites

- American Bar Association: https://www.americanbar.org/

- Legal Services Corporation: https://www.lsc.gov/

- National Association of Legal Assistants: https://www.nala.org/

Articles

- “Legal Escrow: A Guide for Self-Help Legal Representation” by Nolo: https://www.nolo.com/legal-encyclopedia/legal-escrow-guide-self-help-legal-representation.html

- “Understanding Legal Escrow for Self-Represented Litigants” by the California Courts: https://www.courts.ca.gov/selfhelp-litigant-information/understanding-legal-escrow-for-self-represented-litigants.htm

Books

- “Legal Escrow: A Practical Guide for Attorneys and Clients” by Richard J. Podell

- “Self-Help Legal Representation: A Step-by-Step Guide” by David A. Binder

Organizations

- National Center for Legal Aid and Defender Services: 1-800-675-6141

- American Civil Liberties Union: 1-800-338-9144

- Legal Aid Society: 1-800-454-3188

Last Word

Legal escrow can be a valuable tool for self-help legal representation. However, it is important to understand the risks and benefits involved before using legal escrow. By doing your research and choosing a reputable provider, you can help ensure that your legal escrow experience is a positive one.

FAQ Overview: What Are The Legal Escrow Resources For Self-help Legal Representation

What is legal escrow?

Legal escrow is a financial arrangement in which a neutral third party holds funds on behalf of two or more parties until certain conditions are met. In the context of self-help legal representation, legal escrow can be used to hold funds until a settlement is reached or a judgment is entered.

What are the benefits of using legal escrow?

There are several benefits to using legal escrow, including:

- Security: Legal escrow accounts are typically held in FDIC-insured banks, which provides a high level of security for your funds.

- Convenience: Legal escrow can make it easier to manage funds in self-help legal representation. You can deposit funds into the account and withdraw them as needed, without having to worry about the other party having access to the funds.

- Dispute resolution: If there is a dispute between the parties, the escrow agent can help to resolve the dispute and distribute the funds accordingly.

What are the drawbacks of using legal escrow?

There are also some drawbacks to using legal escrow, including:

- Fees: Legal escrow services typically charge a fee for their services. The fees can vary depending on the provider and the type of service provided.

- Time: It can take time to open and close a legal escrow account. This can be a problem if you need to access the funds quickly.

- Complexity: Legal escrow can be a complex process. It is important to understand the terms of the escrow agreement before you sign it.