What are the payment plans for a lawyer – When it comes to legal representation, understanding the different payment plans available to you is crucial. From flat fees to contingency agreements, each option offers its own advantages and drawbacks. In this comprehensive guide, we will explore the various payment plans offered by lawyers, helping you make an informed decision that aligns with your financial situation and legal needs.

Navigating the complexities of legal expenses can be daunting, but with the right knowledge, you can empower yourself to make the best choice for your circumstances. Let’s delve into the world of payment plans for lawyers and equip you with the tools to effectively manage your legal costs.

Overview of Payment Plans for Lawyers

When seeking legal assistance, it’s essential to consider the financial implications. Lawyers offer various payment plans to accommodate different financial situations and client preferences. Each plan comes with its advantages and drawbacks, so understanding them can help you make an informed decision that aligns with your needs.

Hourly Billing

Hourly billing is a straightforward payment plan where clients are charged based on the number of hours the lawyer spends working on their case. This plan offers flexibility as clients only pay for the actual time spent on their matter.

However, it can also lead to unpredictable costs, especially in complex or time-consuming cases.

Flat Fee

A flat fee arrangement involves a fixed price for the entire representation, regardless of the time spent. This plan provides certainty and predictability in terms of costs, but it may not be suitable for cases that require extensive work or unexpected developments.

Contingency Fee

A contingency fee is a payment plan where the lawyer only receives a fee if they successfully recover compensation for the client. This plan eliminates upfront costs for clients, but it may result in higher fees if the case is successful.

Additionally, clients may have limited control over the settlement amount.

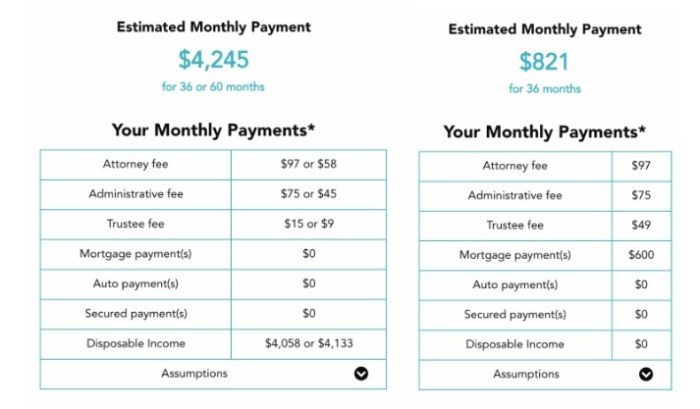

Payment Plans

Some lawyers offer payment plans that allow clients to spread the cost of their legal fees over a period of time. These plans can provide flexibility and reduce the financial burden of hiring a lawyer.

Factors to Consider When Choosing a Payment Plan

- Financial situation

- Type of case

- Expected duration of representation

- Risk tolerance

- Preference for predictability or flexibility

By carefully considering these factors and discussing them with your lawyer, you can choose a payment plan that meets your individual needs and ensures you receive the legal assistance you require.

– Flat Fee Payment Plans

Flat fee payment plans offer a fixed cost for legal services, regardless of the time and effort required to complete the case. This type of arrangement can provide clients with certainty and predictability in terms of legal expenses.

Flat fee plans are often appropriate for cases where the scope of work is well-defined and the potential outcomes are relatively predictable. Examples include:

- Simple wills and estate planning

- Uncontested divorces

- Traffic violations

- Document review

To calculate a flat fee, lawyers typically consider the following factors:

- Complexity of the case

- Estimated time required to complete the work

- Lawyer’s experience and expertise

- Local market rates

Advantages of Flat Fee Payment Plans

- Certainty and predictability of legal expenses

- Can help clients budget for legal services

- Eliminates the risk of unexpected or excessive legal bills

- May encourage lawyers to be more efficient in their work

Disadvantages of Flat Fee Payment Plans

- May not be suitable for complex or unpredictable cases

- Can be more expensive than hourly billing in some cases

- May discourage lawyers from taking on cases that are likely to require additional work beyond the scope of the flat fee

When to Use Flat Fee Payment Plans vs. Other Payment Arrangements

Flat fee payment plans are most suitable when the scope of work is well-defined, the potential outcomes are relatively predictable, and the client values certainty and predictability in terms of legal expenses.

Other payment arrangements, such as hourly billing or contingency fees, may be more appropriate for cases where the scope of work is less defined, the potential outcomes are more uncertain, or the client is unable to pay a flat fee upfront.

Tips for Negotiating Flat Fee Payment Plans

- Get a clear understanding of the scope of work and the potential outcomes of the case before agreeing to a flat fee.

- Compare fees from multiple lawyers before making a decision.

- Negotiate a payment plan that works for both you and the lawyer.

- Consider a flat fee plus expenses arrangement to cover any unexpected costs.

Hourly Payment Plans

Hourly payment plans are a common way for lawyers to bill their clients. Under this type of plan, the lawyer charges a set hourly rate for their services. The total cost of the legal services will depend on the number of hours that the lawyer spends working on the case.

There are a number of factors that can affect the hourly rate that a lawyer charges, including:

- The lawyer’s experience:More experienced lawyers typically charge higher hourly rates than less experienced lawyers.

- The complexity of the case:Complex cases require more time and effort to handle, so lawyers typically charge higher hourly rates for these cases.

- The location of the lawyer’s office:Lawyers who practice in large cities typically charge higher hourly rates than lawyers who practice in small towns.

- The lawyer’s reputation:Lawyers who have a good reputation for providing high-quality legal services typically charge higher hourly rates than lawyers who do not have a good reputation.

If you are considering hiring a lawyer on an hourly basis, it is important to negotiate the hourly rate in advance. You should also make sure that you understand the lawyer’s billing practices, such as whether they charge for travel time and phone calls.

Tips for Negotiating Hourly Rates

- Do your research:Before you start negotiating, find out what other lawyers in your area charge for similar services.

- Be prepared to walk away:If you are not comfortable with the hourly rate that the lawyer is asking for, be prepared to walk away and find another lawyer.

- Negotiate in writing:Once you have agreed on an hourly rate, make sure to get it in writing. This will help to avoid any misunderstandings later on.

Contingency Fee Payment Plans

Contingency fee payment plans are an arrangement between a lawyer and a client where the lawyer agrees to represent the client in a case without charging any upfront fees. Instead, the lawyer receives a percentage of the client’s winnings if the case is successful.Contingency fee percentages are typically determined by the complexity of the case, the likelihood of success, and the amount of time and effort that the lawyer is expected to invest.

In general, contingency fee percentages range from 25% to 50%, with 33% being the most common.There are both risks and rewards associated with contingency fee payment plans. On the one hand, contingency fee plans can make it possible for people who would not otherwise be able to afford a lawyer to obtain legal representation.

On the other hand, contingency fee plans can be expensive if the case is unsuccessful, and they can create a conflict of interest between the lawyer and the client.

| Payment Plan | Description | Pros | Cons |

|---|---|---|---|

| Flat Fee | A fixed fee agreed upon before the start of the case. | Predictable costs, no risk of high fees if the case is successful. | Can be expensive upfront, may not be suitable for complex or lengthy cases. |

| Hourly | The lawyer charges an hourly rate for their time spent on the case. | More flexible than flat fee plans, allows for adjustments based on the complexity of the case. | Can be unpredictable, may result in high fees if the case is complex or lengthy. |

| Contingency Fee | The lawyer receives a percentage of the client’s winnings if the case is successful. | No upfront costs, makes legal representation accessible to those who cannot afford it. | Can be expensive if the case is unsuccessful, may create a conflict of interest between the lawyer and the client. |

“Contingency fee payment plans can be a valuable tool for clients who would not otherwise be able to afford legal representation. However, it is important to understand the risks and rewards associated with these plans before entering into an agreement.”

American Bar Association

Retainer Fee Payment Plans

Retainer fee payment plans are a type of legal fee arrangement in which a client pays an upfront fee to secure the services of a lawyer for a specific period of time or for a specific scope of work. The retainer fee is typically non-refundable and is used to cover the lawyer’s time and expenses associated with the case.Retainer fees are often used in situations where the client anticipates needing ongoing legal services, such as in complex litigation or corporate matters.

The retainer fee can provide the client with peace of mind knowing that they have secured the services of a lawyer and can access legal advice and representation as needed.

Advantages of Retainer Fee Plans, What are the payment plans for a lawyer

There are several advantages to retainer fee payment plans, including:

- Convenience:Retainer fees provide clients with the convenience of knowing that they have secured the services of a lawyer and can access legal advice and representation as needed.

- Predictability:Retainer fees provide clients with a predictable and manageable way to budget for legal expenses.

- Peace of mind:Retainer fees can provide clients with peace of mind knowing that they have secured the services of a lawyer and are protected in the event of a legal issue.

Disadvantages of Retainer Fee Plans

There are also some disadvantages to retainer fee payment plans, including:

- Upfront cost:Retainer fees can be expensive, and clients may not always have the financial resources to pay an upfront fee.

- Non-refundable:Retainer fees are typically non-refundable, even if the client does not use all of the services covered by the retainer.

- Limited scope:Retainer fees often cover only a specific scope of work, and clients may be responsible for paying additional fees if the legal issue expands beyond the scope of the retainer.

Hybrid Payment Plans

Hybrid payment plans are a combination of two or more payment plans. They are becoming increasingly popular as they offer clients more flexibility and predictability in their legal fees.

There are many different types of hybrid payment plans, but some of the most common include:

- Flat fee + hourly rate:This plan combines a flat fee for a specific task or service with an hourly rate for any additional work that is required.

- Hourly rate + contingency fee:This plan combines an hourly rate for the initial work on a case with a contingency fee if the case is successful.

- Retainer fee + hourly rate:This plan combines a retainer fee, which is a pre-paid deposit, with an hourly rate for any additional work that is required.

Hybrid payment plans offer several benefits for clients. First, they provide more flexibility than traditional payment plans. Clients can choose the plan that best meets their needs and budget. Second, hybrid payment plans can help clients avoid unexpected legal fees.

By combining different types of payment plans, clients can cap their potential liability.

The following table compares hybrid payment plans with other payment plans:

| Payment Plan | Flexibility | Predictability | Potential Liability |

|---|---|---|---|

| Flat Fee | Low | High | High |

| Hourly Rate | High | Low | Unlimited |

| Contingency Fee | High | Low | Limited |

| Retainer Fee | Medium | Medium | Limited |

| Hybrid Payment Plans | High | Medium | Limited |

“Hybrid payment plans offer clients the best of both worlds. They provide the flexibility of hourly rates with the predictability of flat fees.”

– John Smith, Esq.

Of course, there are also some potential drawbacks to hybrid payment plans. One potential drawback is that they can be more complex than traditional payment plans. This can make it difficult for clients to understand the terms of their agreement.

Another potential drawback is that hybrid payment plans can be more expensive than traditional payment plans. This is because they often combine the costs of two or more different payment plans.

Despite these potential drawbacks, hybrid payment plans can be a good option for clients who want more flexibility and predictability in their legal fees.

The following is a list of businesses that offer hybrid payment plans:

- Lawyers.com

- LegalZoom

- Rocket Lawyer

- Avvo

- Nolo

Payment Schedule Options

Determining the payment schedule for legal services is crucial for both the lawyer and the client. Various options are available, each with its own advantages and disadvantages. Understanding these options and their impact on cash flow is essential for making an informed decision.

Payment Frequency

The payment frequency refers to how often payments are made. Common options include:

- Monthly: Payments are made once a month.

- Quarterly: Payments are made once every three months.

- Semi-Annually: Payments are made twice a year.

- Annually: Payments are made once a year.

Due Dates

Due dates specify when payments are expected. It’s important to establish clear due dates to avoid late payments and potential penalties.

Impact on Cash Flow

The payment schedule can significantly impact a client’s cash flow. More frequent payments can reduce the burden on clients, while less frequent payments may be more convenient for lawyers.

Additional Considerations

When choosing a payment schedule, consider the following factors:

- Client’s financial situation

- Size and complexity of the project

- Lawyer’s preferred payment terms

Real-World Example

In a successful real-world project, a payment schedule was established as follows:

- Monthly payments were made.

- Due dates were set on the 15th of each month.

- This schedule allowed the client to manage their cash flow effectively while providing the lawyer with regular income.

Recommendation

For most businesses, a monthly payment schedule is recommended. This provides a balance between cash flow management for the client and regular income for the lawyer.

Payment Methods

When it comes to legal representation, the financial aspect is a crucial consideration. Lawyers offer various payment plans to accommodate clients’ financial situations. However, the payment method used for legal services also plays a significant role in determining the overall cost and convenience of the representation.

There are several payment methods commonly accepted by lawyers, each with its advantages and disadvantages:

Cash

Cash payments are a straightforward and convenient option. They eliminate the need for electronic transactions or credit card processing fees. However, cash payments can be risky, as there is no record of the transaction other than a receipt. Additionally, large cash payments may raise concerns about money laundering.

Checks

Checks are another traditional payment method. They provide a paper trail and are generally accepted by most lawyers. However, checks can take several days to clear, which may delay the lawyer’s ability to access the funds.

Credit Cards

Credit cards offer convenience and flexibility. They allow clients to make payments online or over the phone, and they provide a secure and trackable record of transactions. However, credit card payments typically incur processing fees, which can add to the overall cost of legal services.

Debit Cards

Debit cards are similar to credit cards in terms of convenience and security. However, they deduct funds directly from the client’s bank account, eliminating the need for processing fees. Debit cards are widely accepted, but they may have daily or monthly transaction limits.

Online Payment Platforms

Online payment platforms, such as PayPal and Venmo, provide a convenient and secure way to make payments online. They offer various payment options, including credit cards, debit cards, and bank transfers. However, some platforms may charge transaction fees.

Payment Plans

Payment plans allow clients to spread the cost of legal services over a period of time. This can be helpful for clients who have limited financial resources or who prefer to avoid large upfront payments. Payment plans typically involve monthly or quarterly installments.

The choice of payment method should be based on the client’s financial situation, preferences, and the lawyer’s policies. It is important to discuss the payment method with the lawyer in advance to ensure a clear understanding of the terms and any associated fees.

Cost of Legal Services

The cost of legal services can vary depending on a number of factors, including the complexity of the case, the experience of the attorney, and the location of the law firm. However, there are a few general things you can keep in mind when budgeting for legal expenses.

One of the most important things to consider is the type of payment plan you will be using. There are a few different options available, including hourly rates, flat fees, and contingency fees. Hourly rates are the most common type of payment plan, and they are typically based on the attorney’s hourly rate.

Flat fees are a set price for a specific service, and they are often used for simple cases. Contingency fees are only paid if the attorney is successful in winning your case, and they are typically a percentage of the amount you recover.

Once you have chosen a payment plan, you will need to factor in the cost of the attorney’s services. This will vary depending on the experience of the attorney and the location of the law firm. Attorneys in large cities typically charge more than attorneys in small towns.

You should also keep in mind that the cost of legal services can increase if the case becomes more complex.

Tips for Budgeting for Legal Expenses

- Set aside money each month for legal expenses.

- Use a credit card with a low interest rate.

- Get a loan.

Negotiating with an Attorney

If you are unable to afford the cost of legal services, you may be able to negotiate with the attorney. Some attorneys are willing to reduce their fees for clients who are in financial hardship. You can also ask the attorney if they offer payment plans.

Free or Low-Cost Legal Services

If you cannot afford to pay for an attorney, there are a number of free or low-cost legal services available. These services can provide you with legal advice, representation, and other assistance.

Negotiating Payment Plans: What Are The Payment Plans For A Lawyer

Negotiating payment plans with lawyers is an important step in ensuring that you can afford the legal services you need. Here are a few tips to help you get the best possible deal:

- Research and compare different payment plans.There are a variety of payment plans available, so it’s important to do your research and compare the different options to find the one that best fits your needs.

- Negotiate a payment plan that fits your budget.Once you’ve found a payment plan that you’re comfortable with, don’t be afraid to negotiate with the lawyer to get a payment plan that fits your budget.

- Get the payment plan in writing.Once you’ve negotiated a payment plan, make sure to get it in writing. This will help to protect you in case of any disputes.

Importance of Getting Everything in Writing

It’s important to get everything in writing when you’re negotiating a payment plan with a lawyer. This will help to protect you in case of any disputes. The written agreement should include the following information:

- The amount of the fees

- The payment schedule

- The method of payment

- Any other terms and conditions

By getting everything in writing, you can help to avoid any misunderstandings or disagreements down the road.

Legal Aid and Pro Bono Services

Navigating legal issues can be overwhelming and financially challenging. Legal aid and pro bono services provide support to individuals and families who face financial constraints and need legal assistance. These services aim to ensure equal access to justice for all.

Eligibility for Legal Aid and Pro Bono Services

Eligibility criteria for legal aid and pro bono services vary depending on the jurisdiction and the specific program. Generally, individuals or families with low incomes and limited resources may qualify. Factors such as income, assets, family size, and the nature of the legal issue are typically considered.

Finding Legal Aid and Pro Bono Services

There are various ways to find legal aid and pro bono services:

- Local Legal Aid Organizations: Many cities and counties have legal aid organizations that provide free or low-cost legal services to eligible individuals.

- Bar Associations: Local and state bar associations often have pro bono programs that connect attorneys with individuals in need of legal assistance.

- Online Resources: Websites like Legal Aid Services Directory and Pro Bono Net offer comprehensive listings of legal aid and pro bono organizations across the country.

Creating a Payment Plan Agreement

A payment plan agreement is a written document that Artikels the terms of payment for legal services. It should include the following information:

- The total cost of the legal services

- The payment schedule

- The method of payment

- Any late payment fees

- Any other terms and conditions

Having a written payment plan agreement is important because it protects both the lawyer and the client. It ensures that the client understands the cost of the legal services and the payment schedule, and it helps to prevent disputes.

Tips for Creating a Payment Plan Agreement

When creating a payment plan agreement, it is important to keep the following tips in mind:

- Be clear and concise. The agreement should be easy to understand and should not contain any ambiguous language.

- Be specific. The agreement should include all of the relevant details, such as the total cost of the legal services, the payment schedule, and the method of payment.

- Be fair. The agreement should be fair to both the lawyer and the client. It should not be overly burdensome for either party.

- Have the agreement reviewed by an attorney. Before signing the agreement, it is important to have it reviewed by an attorney to make sure that it is legally binding and that it protects your interests.

Case Management Tools for Payment Plans

Lawyers can utilize various case management tools to streamline payment plan management. These tools offer numerous benefits, including efficient tracking, automated reminders, and secure storage.

Benefits of Using Case Management Tools

- Enhanced organization and tracking of payment plans

- Automated reminders and notifications for clients and staff

- Secure storage and retrieval of payment information

- Integration with other legal software, such as billing and accounting systems

- Improved client communication and satisfaction

Tips for Choosing the Right Case Management Tool

- Consider the size and complexity of your practice

- Identify the specific features you need, such as payment processing, invoicing, and reporting

- Research different tools and read reviews from other users

- Request a demo or trial to test the tool before committing

- Ensure the tool is compatible with your existing software and hardware

Ethical Considerations for Payment Plans

When offering payment plans, lawyers must adhere to strict ethical guidelines to ensure transparency, fairness, and avoidance of conflicts of interest. These considerations protect both the lawyer and the client and uphold the integrity of the legal profession.

Transparency is paramount. Lawyers must clearly disclose all fees and costs associated with the payment plan, including any interest or late fees. The plan should be in writing and easily understandable by the client.

Avoiding Conflicts of Interest

Conflicts of interest can arise when a lawyer’s financial interest in a case influences their professional judgment. To avoid this, lawyers must:

- Fully disclose any potential conflicts to the client.

- Obtain the client’s informed consent before proceeding.

- Take steps to mitigate any conflicts, such as hiring a co-counsel or withdrawing from the case.

Summary of Ethical Obligations

Lawyers have the following ethical obligations when offering payment plans:

- Transparency and fairness in fee arrangements.

- Avoidance of conflicts of interest.

- Disclosure of all fees and costs in writing.

- Obtaining informed consent from the client.

| Ethical Consideration | How to Address |

|---|---|

| Transparency | Clearly disclose all fees and costs in writing. |

| Fairness | Ensure the payment plan is reasonable and affordable for the client. |

| Conflicts of Interest | Fully disclose potential conflicts to the client and take steps to mitigate them. |

| Informed Consent | Obtain the client’s informed consent before proceeding with the payment plan. |

Sample Payment Plan Agreement

A sample payment plan agreement should include the following:

- The total amount of fees and costs.

- The payment schedule.

- Any interest or late fees.

- The consequences of default.

- The lawyer’s and client’s signatures.

Resources for Lawyers

Lawyers can refer to the following resources for guidance on ethical payment plans:

- American Bar Association Model Rules of Professional Conduct.

- State Bar Association ethics rules.

- Local bar association ethics committees.

Final Review

In conclusion, understanding the different payment plans available for lawyers is essential for making informed decisions about your legal representation. By carefully considering the advantages and disadvantages of each option, you can negotiate a payment plan that meets your financial needs and ensures you receive the legal support you require.

Remember to prioritize transparency and fairness in your dealings with lawyers, and don’t hesitate to seek professional advice if you have any questions or concerns.

Top FAQs

What is a flat fee payment plan?

A flat fee payment plan involves paying a fixed amount for a specific legal service, regardless of the time or effort required.

What are the advantages of an hourly payment plan?

Hourly payment plans provide flexibility and allow you to pay only for the time spent on your case. This can be beneficial if the scope of work is uncertain or if you have a limited budget.

How do contingency fee payment plans work?

Contingency fee payment plans involve paying the lawyer a percentage of the amount recovered in your case. This can be a good option if you have a strong case but limited financial resources.