What are the quarterly costs of hiring a lawyer? This question can be daunting, especially if you’re facing a legal issue for the first time. Legal fees can vary widely depending on a number of factors, including the type of case, the lawyer’s experience, and the location of the law firm.

In this article, we’ll provide you with a comprehensive guide to budgeting for legal services, so you can make informed decisions about your legal representation.

In this article, we’ll cover the following topics:

- Quarterly retainer fees

- Hourly rates

- Additional expenses

- Legal fees

- Payment options

- Contingency fees

- Negotiating fees

- Fixed fees

- Billing practices

- Factors to consider

- Case studies

- Cost-saving strategies

- Online legal services

- Legal aid

- Impact of legal expenses on business

- Legal expense insurance

Quarterly Retainer Fees: What Are The Quarterly Costs Of Hiring A Lawyer

Quarterly retainer fees are a common way for attorneys to charge for their services. This type of fee arrangement provides clients with a predictable and manageable way to budget for legal expenses.

The typical range of quarterly retainer fees varies depending on the type of legal service being provided. For example, business law attorneys may charge retainer fees in the range of $1,000 to $5,000 per quarter, while criminal defense attorneys may charge retainer fees in the range of $5,000 to $10,000 per quarter.

Factors Influencing Retainer Fee Amounts

There are a number of factors that can influence the amount of a retainer fee, including:

- The experience of the attorney

- The location of the law firm

- The complexity of the case

- The expected duration of the representation

For example, an attorney with a lot of experience in a particular area of law may charge a higher retainer fee than an attorney with less experience. Similarly, an attorney located in a large metropolitan area may charge a higher retainer fee than an attorney located in a smaller town.

Provisions in Retainer Fee Agreements

Retainer fee agreements typically include a number of provisions, such as:

- Payment schedules

- Scope of services covered

- Termination of the agreement

Payment schedules specify how and when the retainer fee will be paid. Scope of services provisions describe the specific legal services that will be provided. Termination provisions specify the conditions under which the retainer fee agreement can be terminated.

Ethical Considerations

Attorneys must take into account a number of ethical considerations when setting retainer fees. For example, attorneys must avoid charging excessive fees and must disclose all fees to clients in writing.

Sample Retainer Fee Agreement

The following is a sample retainer fee agreement for estate planning services:

Retainer Fee AgreementClient:[Client Name] Attorney:[Attorney Name] Services to be Provided:Estate planning services, including the preparation of a will, trust, and power of attorney. Retainer Fee:$2,500 Payment Schedule:The retainer fee is due in full at the time of signing this agreement. Scope of Services:The attorney will provide the following services:

- Meet with the client to discuss their estate planning goals

- Prepare a will, trust, and power of attorney

- Review the client’s estate plan annually and make any necessary changes

Termination of Agreement:This agreement may be terminated by either party with 30 days’ written notice.

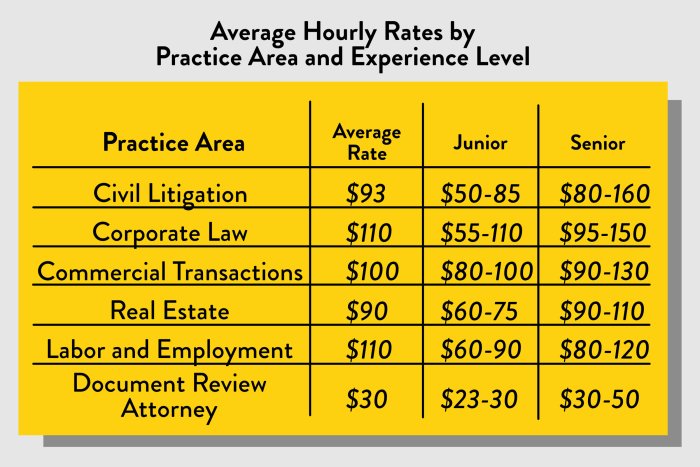

Hourly Rates

Lawyers charge hourly rates for their services, and these rates can vary significantly depending on a number of factors. These factors include the practice area, the seniority of the lawyer, the geographic location, and the market demand for legal services.

Practice Area

The practice area of a lawyer has a significant impact on their hourly rate. Lawyers who specialize in complex or niche areas of law, such as corporate law or patent law, typically charge higher hourly rates than lawyers who practice in more general areas of law, such as family law or criminal law.

Seniority

The seniority of a lawyer also affects their hourly rate. Partners in law firms typically charge higher hourly rates than associates, and associates charge higher hourly rates than paralegals.

Geographic Location

The geographic location of a lawyer can also affect their hourly rate. Lawyers who practice in major metropolitan areas, such as New York City or Los Angeles, typically charge higher hourly rates than lawyers who practice in rural areas.

Market Demand

The market demand for legal services can also affect hourly rates. When there is a high demand for legal services, lawyers can charge higher hourly rates. Conversely, when there is a low demand for legal services, lawyers may be forced to lower their hourly rates.

Ethical Considerations

There are a number of ethical considerations that lawyers must take into account when setting their hourly rates. Lawyers must ensure that their rates are fair and reasonable, and that they do not take advantage of their clients.

Hourly Rate Table

The following table provides a general overview of the average hourly rates charged by lawyers for various practice areas and seniority levels:

| Practice Area | Partner | Associate | Paralegal |

|---|---|---|---|

| Corporate Law | $500-$1,000 | $250-$500 | $100-$250 |

| Litigation | $400-$800 | $200-$400 | $100-$200 |

| Family Law | $300-$600 | $150-$300 | $75-$150 |

| Criminal Law | $250-$500 | $125-$250 | $50-$125 |

Additional Expenses

In addition to the quarterly retainer fees and hourly rates discussed earlier, there are several additional expenses that can impact the overall cost of hiring a lawyer. These expenses can vary depending on the nature of the legal services required, the complexity of the case, and the location of the law firm.

It’s essential to be aware of these potential expenses and factor them into your budget when hiring a lawyer. This will help you avoid any unexpected financial surprises down the road.

Filing Fees

- Filing fees are charged by the court for filing legal documents, such as a complaint, motion, or appeal. These fees can vary depending on the type of case and the jurisdiction.

- For example, filing a complaint in federal court can cost around $400, while filing an appeal can cost over $500.

Court Costs

- Court costs are other expenses that may be incurred during the course of a legal proceeding. These costs can include fees for things like jury fees, witness fees, and court reporters.

- The amount of court costs can vary significantly depending on the case and the jurisdiction.

Expert Witness Fees

- Expert witness fees are paid to experts who testify on behalf of one of the parties in a legal proceeding. These fees can be substantial, depending on the expert’s qualifications and experience.

- For example, an expert witness with a Ph.D. in a specialized field may charge several thousand dollars per day to testify.

Other Miscellaneous Expenses

- Other miscellaneous expenses that may be incurred during the course of a legal proceeding can include things like travel expenses, copying costs, and postage.

- The amount of these expenses will vary depending on the case and the lawyer’s practice.

These are just a few of the additional expenses that can be associated with hiring a lawyer. It’s important to discuss these expenses with your lawyer in advance so that you can budget accordingly.

Strategies for Minimizing or Negotiating Expenses

- There are several strategies that you can use to minimize or negotiate these additional expenses.

- For example, you can ask your lawyer for a discount on their hourly rate or negotiate a flat fee for certain services.

- You can also try to negotiate a payment plan that fits your budget.

Tips for Budgeting for Additional Expenses

- When budgeting for additional expenses, it’s important to be realistic about the potential costs involved.

- Talk to your lawyer about the specific expenses that you may incur and get an estimate of the total cost.

- Once you have a budget, stick to it as closely as possible.

Contingency Fees

Contingency fees are a unique fee structure in which lawyers are only paid if they win the case. This differs from traditional fee structures, where lawyers are paid an hourly rate or a flat fee regardless of the outcome of the case.

Contingency fees are often used in personal injury cases, where the client may not have the financial resources to pay for a lawyer upfront. In these cases, the lawyer agrees to take the case on a contingency basis, meaning that they will only be paid if they win the case.

The lawyer’s fee is typically a percentage of the settlement or verdict.

Ethical Implications of Contingency Fees

Contingency fees can raise ethical concerns, as they may create a conflict of interest between the lawyer and the client. For example, a lawyer may be tempted to take on cases that are likely to settle quickly and easily, even if they are not in the best interests of the client.

Additionally, lawyers may be tempted to delay settlement negotiations in order to increase their fees.

Advantages and Disadvantages of Contingency Fees

There are both advantages and disadvantages to contingency fees for both clients and attorneys.

- Advantages for clients:

- Clients do not have to pay any upfront costs.

- Clients only pay if they win the case.

- Contingency fees can help to level the playing field between clients and defendants.

- Advantages for attorneys:

- Contingency fees can provide attorneys with a steady stream of income.

- Contingency fees can help to attract clients who would not otherwise be able to afford legal representation.

- Contingency fees can motivate attorneys to work hard on their cases.

- Disadvantages for clients:

- Clients may end up paying more in legal fees than they would under a traditional fee structure.

- Clients may not have control over the decisions made by their lawyer.

- Clients may be pressured to settle their case quickly, even if it is not in their best interests.

- Disadvantages for attorneys:

- Attorneys may not get paid if they lose the case.

- Attorneys may have to work on cases that are not in their area of expertise.

- Attorneys may have to deal with difficult clients.

Calculating Contingency Fees

Contingency fees are typically calculated as a percentage of the settlement or verdict. The percentage varies depending on the jurisdiction, the type of case, and the experience of the lawyer. In most cases, contingency fees range from 33% to 40%.

However, contingency fees can be as high as 50% in some cases.

Negotiating Contingency Fee Agreements

When negotiating a contingency fee agreement, it is important to consider the following factors:

- The likelihood of success.

- The amount of money at stake.

- The lawyer’s experience and reputation.

- The client’s financial situation.

It is also important to get the contingency fee agreement in writing. The agreement should clearly state the percentage of the settlement or verdict that the lawyer will receive, as well as any other fees or costs that the client may be responsible for.

Negotiating Fees

Negotiating legal fees can be a daunting task, but it’s essential to ensure you get the best possible deal for your legal needs. Here are some tips to help you negotiate effectively:

Research and Preparation

Before you start negotiating, research the average fees for similar legal services in your area. This will give you a good starting point for your negotiations. You should also gather all the relevant information about your case, including the facts, the legal issues involved, and your desired outcome.

Be Clear About Your Budget

Before you start negotiating, it’s important to be clear about your budget. This will help you avoid getting into a situation where you agree to fees that you can’t afford. Be prepared to discuss your budget with the lawyer and be willing to compromise if necessary.

Negotiate in Person

If possible, negotiate your fees in person. This will give you the opportunity to build a rapport with the lawyer and to get a better sense of their personality and communication style. It will also make it easier to negotiate effectively.

Be Prepared to Walk Away

If you’re not comfortable with the lawyer’s fees, don’t be afraid to walk away. There are plenty of other lawyers out there who will be willing to work with you on a fee that you can afford.

Contingency Fees, What are the quarterly costs of hiring a lawyer

In some cases, you may be able to negotiate a contingency fee with your lawyer. This means that you will only pay the lawyer if you win your case. Contingency fees are often used in personal injury cases and other cases where the outcome is uncertain.

If you’re considering a contingency fee, be sure to negotiate the percentage of the settlement or award that the lawyer will receive. You should also make sure that the lawyer is experienced in handling cases like yours.

Sample Negotiation Scenario

You’re negotiating fees with a lawyer for a personal injury case. You’ve done your research and you know that the average fee for similar cases in your area is $3,000. You’re willing to pay $2,500, but you’re hoping to get the lawyer to agree to $2,000.

You start by telling the lawyer that you’re very interested in their services, but that you have a budget of $2,500. The lawyer responds by saying that their standard fee is $3,000, but that they’re willing to negotiate.

You then explain that you’re a single mother with two young children and that you can’t afford to pay $3,000. The lawyer understands your situation and agrees to reduce their fee to $2,250.

You’re happy with this compromise and you agree to hire the lawyer.

Fixed Fees

Fixed-fee arrangements are a popular option for legal services because they provide certainty and predictability in terms of costs. Under a fixed-fee arrangement, the lawyer agrees to provide a specific set of services for a fixed price, regardless of the amount of time or effort required.

There are several advantages to fixed-fee arrangements. First, they provide clients with a clear understanding of the total cost of their legal services upfront. This can help clients budget for their legal expenses and avoid unexpected costs. Second, fixed-fee arrangements can help to reduce the risk of disputes between clients and lawyers over fees.

Finally, fixed-fee arrangements can incentivize lawyers to be efficient and effective in their work.

However, there are also some disadvantages to fixed-fee arrangements. First, fixed-fee arrangements may not be suitable for all types of legal services. For example, they may not be appropriate for cases that are likely to be complex or time-consuming. Second, fixed-fee arrangements may not be the most cost-effective option for clients who are only seeking limited legal services.

Examples of Legal Services that are Commonly Handled on a Fixed-Fee Basis

- Estate planning

- Business formation

- Real estate transactions

- Uncontested divorces

- Simple wills

Billing Practices

Lawyers employ various billing practices to manage their fees and expenses. Understanding these practices is crucial for clients to ensure transparency and avoid unexpected charges. This section will explore common billing practices, their implications, and tips for negotiating and reviewing legal bills.

Billing Statements and Invoices

Lawyers typically issue monthly statements or detailed invoices that Artikel the services provided, hours worked, expenses incurred, and the total amount due. These documents should be clear and easy to understand, providing clients with a comprehensive breakdown of the fees charged.

Hourly Rates

Hourly rates are a common billing practice where lawyers charge clients based on the number of hours spent working on their case. The hourly rate varies depending on the lawyer’s experience, expertise, and location. Clients should negotiate the hourly rate in advance to avoid any surprises.

Contingency Fees, What are the quarterly costs of hiring a lawyer

Contingency fees are an alternative billing arrangement where lawyers receive a percentage of the client’s recovery if the case is successful. This arrangement is often used in personal injury or class action cases where the client may not have the upfront funds to pay for legal services.

Flat Fees

Flat fees are fixed amounts charged for specific legal services, such as drafting a will or handling a real estate transaction. This arrangement provides clients with certainty regarding the total cost of legal services.

Negotiating and Reviewing Legal Bills

Clients should carefully review legal bills to ensure accuracy and fairness. They should ask questions about any unclear charges or expenses. If necessary, clients can negotiate with their lawyers to reduce the fees or payment terms.

Ethical Considerations

Lawyers have an ethical obligation to bill clients fairly and transparently. Conflicts of interest may arise if the lawyer’s billing practices incentivize them to prolong the case or engage in unnecessary legal work. Clients should be aware of these potential conflicts and discuss them with their lawyers.

Factors to Consider

Budgeting for quarterly legal expenses necessitates careful consideration of several factors. Evaluating the value of legal services and weighing the costs against potential benefits is crucial for informed decision-making.

Understanding the scope of legal services required, the complexity of the case, and the experience and reputation of the lawyer can provide valuable insights into the potential costs and benefits of hiring legal counsel.

Evaluating Legal Value

- Assess the complexity of the legal issue and the potential impact on your business or personal life.

- Consider the potential benefits of legal representation, such as risk mitigation, dispute resolution, and legal compliance.

- Research the lawyer’s experience, track record, and reputation to determine their expertise in the relevant legal area.

Weighing Costs and Benefits

- Compare the cost of legal services to the potential financial and non-financial benefits of hiring a lawyer.

- Consider the long-term implications of legal representation, such as avoiding costly legal disputes or protecting valuable assets.

- Evaluate the potential impact of legal fees on your overall budget and financial stability.

Comparing Different Fee Structures for Legal Services

When hiring a lawyer, it’s important to understand the different fee structures available to you. The most common fee structures are retainer fees, hourly rates, contingency fees, and fixed fees. Each structure has its own advantages and disadvantages, so it’s important to choose the one that’s right for your needs.

Retainer Fees

A retainer fee is a payment that you make to a lawyer in advance to secure their services. The retainer fee is typically used to cover the lawyer’s time and expenses for a specific period of time, such as a month or a year.

If the lawyer does not use all of the retainer fee during the specified period, the remaining balance will be refunded to you.

Advantages of retainer fees:

- Retainer fees can help you to budget for legal expenses.

- Retainer fees can give you peace of mind knowing that you have a lawyer on retainer who is available to help you with any legal issues that may arise.

Disadvantages of retainer fees:

- Retainer fees can be expensive.

- Retainer fees may not be refundable if you do not use all of the lawyer’s time during the specified period.

Hourly Rates

Hourly rates are the most common fee structure for legal services. Under an hourly rate agreement, you will be charged for the actual time that the lawyer spends working on your case. The hourly rate will vary depending on the lawyer’s experience, expertise, and location.

Advantages of hourly rates:

- Hourly rates can be more affordable than retainer fees.

- Hourly rates allow you to only pay for the time that the lawyer actually spends working on your case.

Disadvantages of hourly rates:

- Hourly rates can be unpredictable, as you may not know how much time the lawyer will spend working on your case.

- Hourly rates can be expensive if the lawyer’s hourly rate is high.

Contingency Fees, What are the quarterly costs of hiring a lawyer

Contingency fees are a type of fee structure in which the lawyer does not charge a fee unless they win your case. If the lawyer wins your case, they will typically receive a percentage of the settlement or award. Contingency fees are most common in personal injury cases.

Advantages of contingency fees:

- Contingency fees can make it possible for you to hire a lawyer even if you do not have any money.

- Contingency fees can motivate the lawyer to work hard to win your case.

Disadvantages of contingency fees:

- Contingency fees can be expensive if you win your case.

- Contingency fees may not be available in all types of cases.

Fixed Fees

Fixed fees are a type of fee structure in which the lawyer agrees to charge a set fee for a specific service. Fixed fees are most common in simple legal matters, such as drafting a will or a contract.

Advantages of fixed fees:

- Fixed fees can help you to budget for legal expenses.

- Fixed fees give you peace of mind knowing that you will not be charged more than the agreed-upon fee.

Disadvantages of fixed fees:

- Fixed fees may be more expensive than other fee structures.

- Fixed fees may not be available in all types of cases.

Factors to Consider When Choosing a Fee Structure

When choosing a fee structure, it’s important to consider the following factors:

- The type of legal matter

- The complexity of the legal matter

- Your budget

- The lawyer’s experience and expertise

- The lawyer’s reputation

Case Studies

Real-life examples provide valuable insights into the practical aspects of hiring a lawyer and the costs involved. These case studies illustrate how various factors influence the fees charged and the outcomes of legal matters.

By examining specific cases, we can better understand the complexities of legal fees and make informed decisions when seeking legal representation.

Civil Litigation

- Case:Breach of contract dispute between two businesses.

- Fees:$10,000 quarterly retainer, plus hourly rates for additional work.

- Factors:Complexity of the case, potential damages, and the reputation of the law firm.

- Outcome:The case settled out of court, resulting in a favorable settlement for the client.

Criminal Defense

- Case:DUI charge with a prior conviction.

- Fees:$5,000 flat fee.

- Factors:Severity of the charge, prior criminal history, and the lawyer’s experience in DUI cases.

- Outcome:The lawyer successfully negotiated a plea deal, resulting in reduced charges and no jail time.

Family Law

- Case:Divorce with child custody and property division.

- Fees:$7,500 quarterly retainer, plus additional expenses.

- Factors:Assets involved, number of children, and the level of conflict between the parties.

- Outcome:The case resulted in a fair and equitable settlement for both parties, with minimal disruption to the children.

Cost-Saving Strategies

Hiring a lawyer can be expensive, but there are several strategies you can use to reduce the quarterly costs of legal services.

One way to save money is to use technology. There are a number of online legal services that can provide you with affordable access to legal advice and representation. These services can be especially helpful for small businesses and individuals who need occasional legal assistance.

Alternative Dispute Resolution Methods

Another way to save money on legal fees is to seek alternative dispute resolution methods. ADR methods, such as mediation and arbitration, can be less expensive and time-consuming than going to court.

Negotiating Favorable Payment Plans

Finally, you can also negotiate favorable payment plans with your lawyer. Many lawyers are willing to work with clients on a payment plan that fits their budget. Be sure to discuss your payment options with your lawyer before you hire them.

Online Legal Services

With the advancement of technology, online legal services have emerged as a cost-effective alternative to traditional law firms. These services offer various legal assistance and document preparation at a fraction of the cost of hiring a lawyer.

One of the main benefits of using online legal services is their affordability. These services typically charge flat fees for specific legal tasks, such as drafting wills, contracts, or handling simple legal matters. This eliminates the uncertainty and potential high costs associated with hourly billing practices common in traditional law firms.

Limitations and Benefits

While online legal services offer cost savings, it’s important to be aware of their limitations. These services may not be suitable for complex legal matters that require extensive research, court appearances, or specialized legal expertise. Additionally, online legal services often lack the personal touch and direct communication that clients may prefer.

However, for simple legal needs, online legal services can provide a convenient and affordable option. They offer flexibility, as clients can access these services from anywhere with an internet connection. Moreover, online legal services can be a valuable resource for individuals who may not have the means to hire a traditional lawyer.

Legal Aid

Legal aid programs provide free or low-cost legal services to individuals who meet certain eligibility criteria. These programs are designed to ensure that everyone has access to justice, regardless of their financial situation.

To qualify for legal aid, individuals must typically meet income and asset requirements. The specific criteria vary from program to program, but generally, applicants must have a low income and limited assets. Legal aid programs typically offer a range of legal services, including:

- Family law

- Housing disputes

- Criminal defense

- Immigration law

- Consumer protection

To apply for legal aid, individuals should contact their local legal aid office. The application process typically involves completing an intake form and providing documentation to verify income and assets. The approval process can take several weeks or months, depending on the program.

| Region | Eligibility Requirements | Services Offered | Contact Information |

|---|---|---|---|

| California | Income below 125% of the federal poverty level | Family law, housing disputes, criminal defense, immigration law, consumer protection | California Legal Services (800) 252-5666 |

| New York | Income below 150% of the federal poverty level | Family law, housing disputes, criminal defense, immigration law, consumer protection | New York Legal Assistance Group (888) 663-5342 |

| Texas | Income below 125% of the federal poverty level | Family law, housing disputes, criminal defense, immigration law, consumer protection | Texas Legal Services Center (800) 252-9101 |

Seeking legal aid has numerous benefits. It can help individuals:

- Gain access to justice

- Reduce stress

- Improve their chances of a favorable outcome

If you are facing a legal challenge and need assistance, do not hesitate to seek legal aid. Legal aid programs can provide you with the support you need to navigate the legal system and protect your rights.

Impact of Legal Expenses on Business

Legal expenses can have a significant impact on business operations, potentially affecting profitability, cash flow, and reputation.

To manage legal costs effectively, businesses should consider the following strategies:

Negotiating Fees

- Negotiate retainer fees and hourly rates with legal counsel.

- Explore alternative fee arrangements, such as contingency fees or fixed fees.

Managing Expenses

- Establish a legal budget and track expenses carefully.

- Use technology to automate tasks and reduce administrative costs.

- Outsource non-core legal functions to save on overhead.

Minimizing Risk

- Implement risk management strategies to identify and mitigate potential legal liabilities.

- Obtain adequate insurance coverage to protect against unexpected legal expenses.

Legal Expense Insurance

Legal expense insurance is a type of insurance policy that helps cover the costs of hiring a lawyer. It can provide coverage for a wide range of legal services, including:

- Legal advice

- Document review

- Negotiation

- Representation in court

There are different types of legal expense insurance policies available, each with its own set of benefits and limitations. Some policies cover only specific types of legal services, while others provide more comprehensive coverage. The cost of a policy will vary depending on the level of coverage and the deductible.When purchasing a legal expense insurance policy, it is important to consider the following factors:

- The types of legal services that are covered

- The amount of coverage that is provided

- The deductible

- The cost of the policy

Legal expense insurance can be a valuable way to protect yourself from the financial costs of hiring a lawyer. It can provide peace of mind knowing that you have coverage in the event of a legal dispute.

Outcome Summary

We hope this guide has been helpful in providing you with a better understanding of the quarterly costs of hiring a lawyer. Remember, the best way to get an accurate estimate of the costs involved in your case is to consult with a qualified attorney.

Q&A

What are the typical quarterly retainer fees for different types of legal services?

The typical quarterly retainer fees for different types of legal services can vary widely. For example, the average quarterly retainer fee for a business lawyer is between $2,500 and $5,000, while the average quarterly retainer fee for a criminal defense lawyer is between $5,000 and $10,000.

What factors influence retainer fee amounts?

There are a number of factors that can influence retainer fee amounts, including the experience of the attorney, the location of the law firm, the complexity of the case, and the expected duration of the representation.

What are the different types of legal fees?

There are three main types of legal fees: hourly rates, contingency fees, and flat fees.

What are the advantages and disadvantages of each type of legal fee?

Hourly rates are the most common type of legal fee. The advantage of hourly rates is that you only pay for the time that the lawyer spends working on your case. The disadvantage of hourly rates is that they can be expensive, especially if your case is complex or time-consuming.

Contingency fees are a type of legal fee in which the lawyer only gets paid if you win your case. The advantage of contingency fees is that you don’t have to pay anything upfront. The disadvantage of contingency fees is that the lawyer will typically take a percentage of your settlement or judgment, which can be a significant amount of money.

Flat fees are a type of legal fee in which the lawyer agrees to charge a fixed amount for their services. The advantage of flat fees is that you know exactly how much you will be paying for the lawyer’s services.

The disadvantage of flat fees is that they can be more expensive than hourly rates or contingency fees if your case is complex or time-consuming.